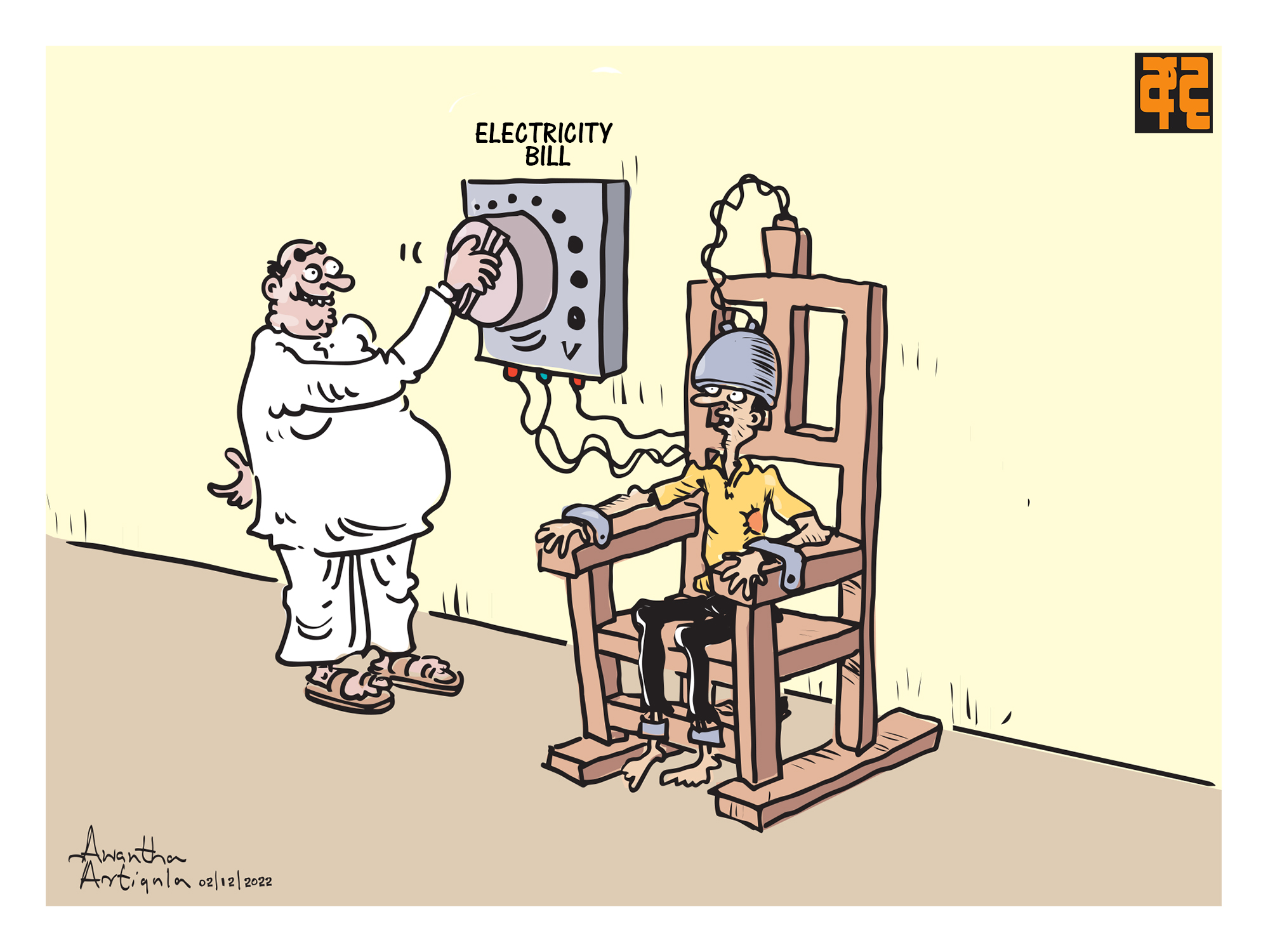

The International Monetary Fund (IMF), in its latest report on Sri Lanka has proposed an imputed rental income tax from owner-occupied and vacant residential property to be introduced by April 1, 2025, with an exemption threshold and a graduated tax rate schedule.

The report says the introduction of such a tax is critical to sustain revenue mobilization efforts as a substitute for the property tax which was initially planned for 2025 but faced institutional impediments.

It says establishing a database on property valuation that includes information such as assessed values, latest assessment date, and property type in all municipal councils by August 2024.

“Fully operationalizing a nationwide digital Sales Price and Rents Register (SPRR) by end-March 2025, accessible by the Inland Revenue Department (IRD), the valuation department, the land registry, and the public (proposed SB). This digital SPRR would be the key resource for assessing property values and the imputed rental income tax,” it says.

It also stated that important vulnerabilities and uncertainties remain, including with respect to the ongoing debt restructuring and the upcoming elections, and its directors, against this backdrop, called on the authorities to continue strengthening macroeconomic policies to restore economic stability and debt sustainability and to sustain the reform momentum to promote long-term inclusive growth.

The IMF Executive Board completed the 2024 Article IV Consultation and Second Review under the 48-month Extended Fund Facility with Sri Lanka, providing the country with immediate access to SDR 254 million (about US $336 million) to support its economic policies and reforms.

The Asset Recovery Bill, after much-needed public consultation, should be enacted by November 2024.

(Daily Mirror)