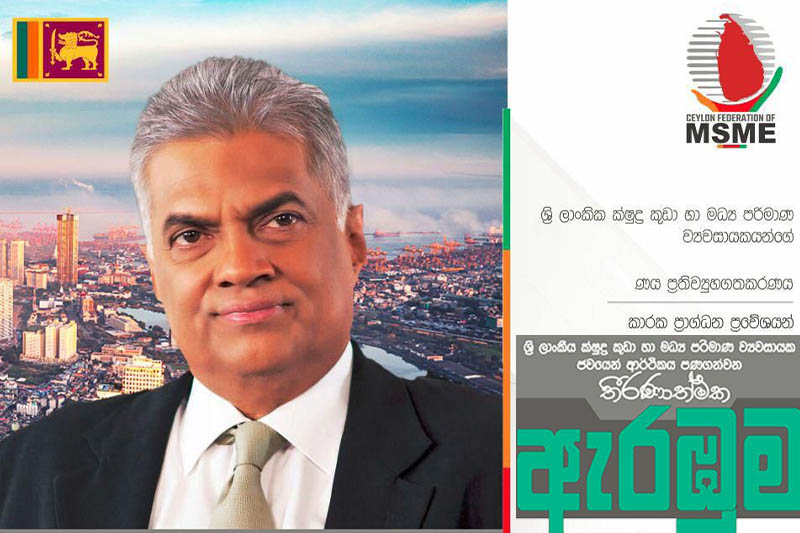

Over 500 MSMEs to meet President today at BMICH

Over 500 micro, small and medium scale entrepreneurs will meet President Ranil Wickremesinghe today (19) at 4 p.m. at the Bandaranaike Memorial International Conference Hall under an initiative by the Ceylon Federation of MSMEs.