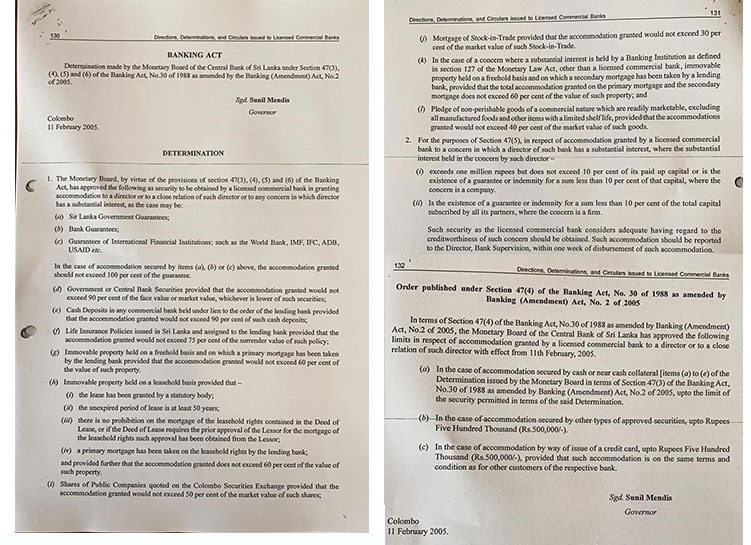

According to the instructions issued by the Central Bank to both public and private commercial banks, if a member of the Board of Directors of such a bank obtains a loan for himself or family and friends, it is mandatory to offer guarantees. However, no such guarantee has been obtained when granting this loan.

The CSBL issued an order to all commercial banks in this regard in 2005 and a copy is found below.

However, People's Bank Chairman Sujeewa Rajapakse, a senior chartered accountant, has illegally obtained Rs. 25 million at an interest of 4% on behalf of BDO Partners, the company of which he is a managing partner, defying the directives issued by the Central Bank.

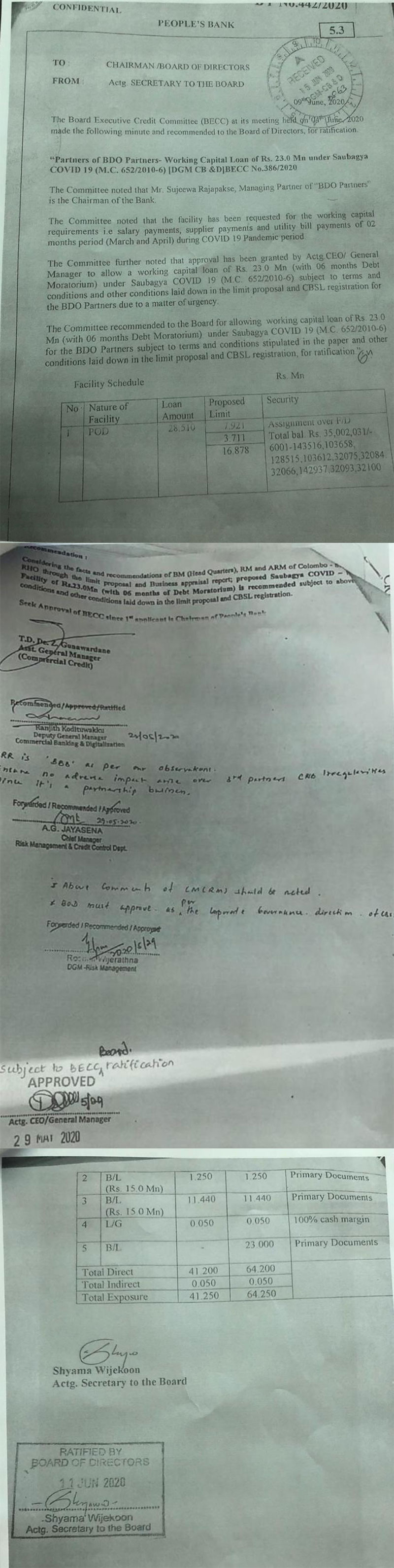

The minutes of the Board meetings of the People's Bank would shed light on this matter.

The Convenor of the 'Sinhala' organisation, Ven. Madille Pannaloka Thera made a special revelation regarding this fraud recently. He pointed out that it is the government's responsibility to immediately investigate this fraud committed by the Chairman of the People's Bank.

Ven. Pannaloka Thera called for a special press briefing and urged Finance Minister, Premier Mahinda Rajapaksa to first suspend or remove the Chairman in order to conduct an impartial inquiry.

He said that the Chairman had not even obtained permission from the board of directors of the People's Bank to obtain the loan.

He claimed that BDO Partners was one of the firms that compiled reports justifying the Central Bank bond scam when Sujeewa Rajapakse was the Managing Partner of the company.

According to reports, it was President's Secretary Dr. PB Jayasundera who had recommended Sujeewa Rajapakse for the post of Chairman of the People's Bank.

He also alleged that the Central Bank has suppressed Rajapakse's assessment with regard to the Fitness and Propriety (honesty, integrity and reputation, competence, capability, and financial soundness) test that needs to be considered when appointing a chairperson to a commercial bank.

The Convenor of the 'Sinhale' organisation Ven. Madille Pannaloka Thero revealed at the media briefing that Sujeewa Rajapkakse had involved a third party to obtain kickbacks from the Mashreq Bank in the United Arab Emirates pertaining to a state loan of $250 million.

He further said that it is surprising that the Committee on High Posts of the Parliament of Sri Lanka would recommend to give a high post to such a person.