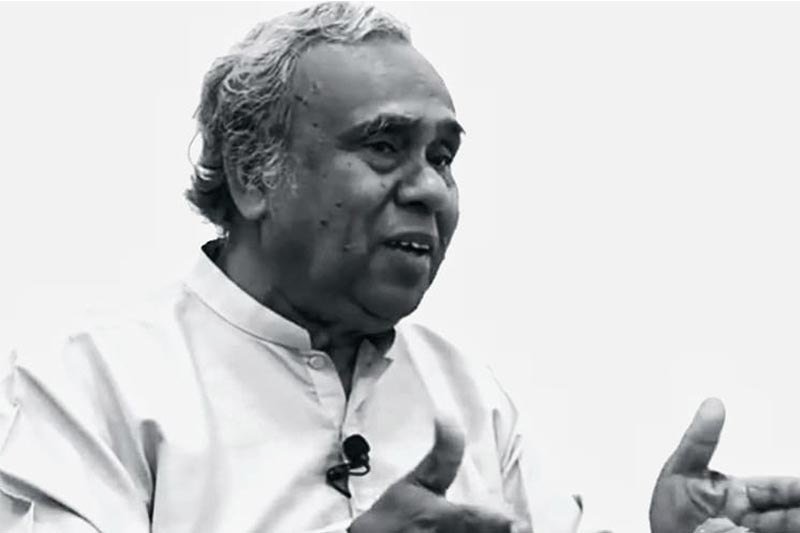

State Finance Minister Ranjith Siyambalapitiya said yesterday (08) that the government is prepared to reassess the inclusion of 97 out of the 138 items slated for the application of Value-Added Tax (VAT) starting January 1, 2024.

Siyambalapitiya made this statement while addressing the adjournment debate in parliament, specifically discussing the decision to incorporate local food production into the VAT system.

He said the government is prepared to take into consideration the concerns raised by various parties with regard to the proposed removal of VAT exemptions.

He said the government expects to generate an income of Rs.378 billion through the revision of the list of goods exempt from VAT.

Siyambalapitiya noted that the government aims to increase its revenue to 12 percent of Gross Domestic Product (GDP) in 2024 from the current level of 9.2 percent of GDP and to achieve this goal, a decision has been made to implement amendments to the income tax structure.

The minister highlighted that the country has reached an opportune moment to pursue a long-term, sustainable solution to its economic issues, having relied on short-term band-aid solutions for many years.

Highlighting the reasons for the tax increases, Siyambalapitiya pointed out that the welfare expenditure of Rs.187 billion in 2023 has been increased to Rs.207 billion in 2024. In addition, 70 percent of the government revenue is to be repaid as loan interest.

The government has increased the VAT rate by 3 percent to 18 percent with effect from January 1, 2024, and proposed to remove VAT exemptions except from education, healthcare and certain essential food items.

(Daily Mirror)