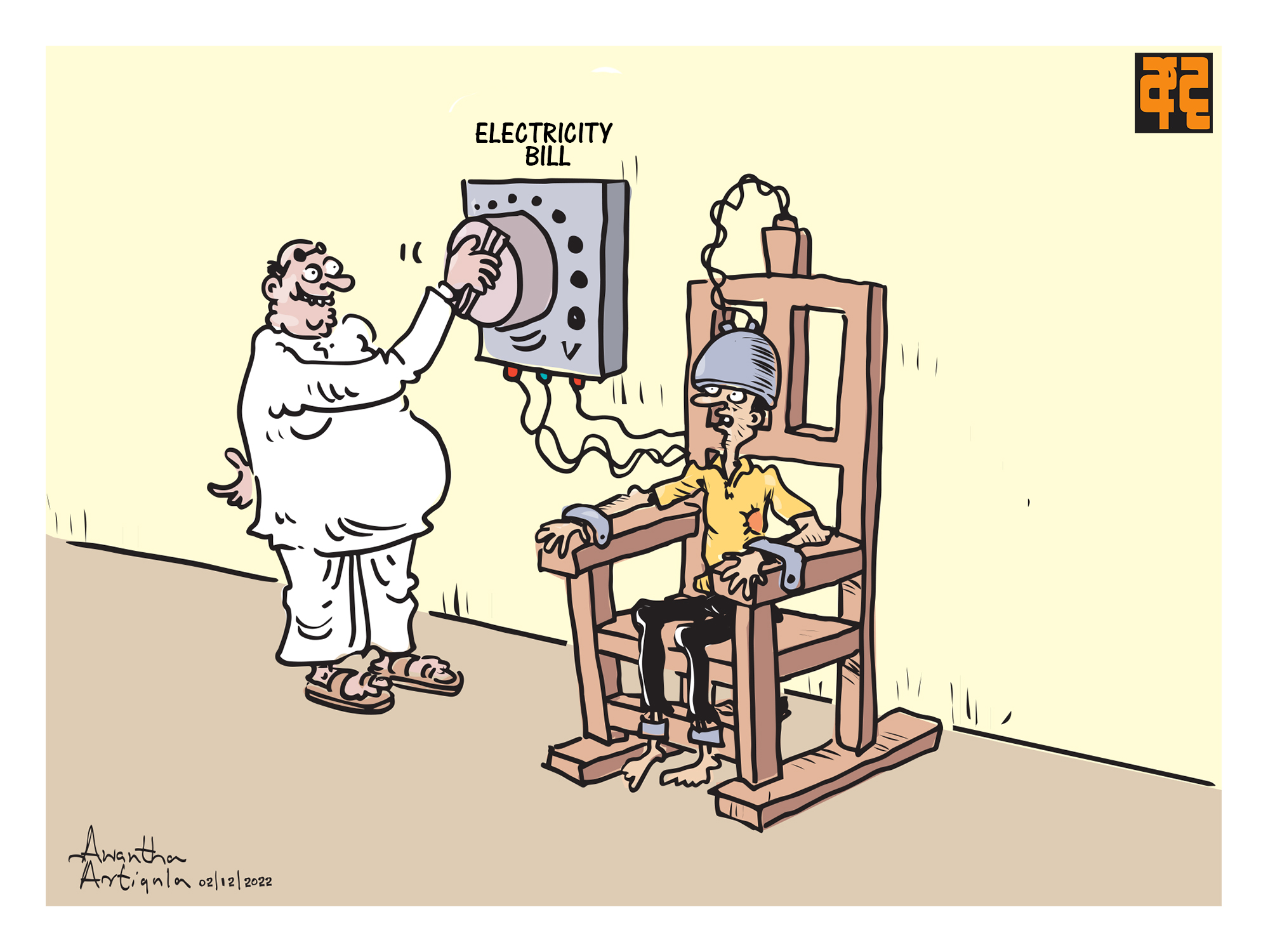

Global rating agency Moody's yesterday placed Sri Lanka's “Caa1” foreign currency long-term issuer and senior unsecured debt ratings under review for downgrade.

The rating decision is driven by assessment that the island nation's increasingly fragile external liquidity position raises the risk of default.

It also reflects governance weaknesses in the ability of the country's institutions to decisively mitigate significant and urgent risks to the balance of payments.

Although the government has secured some financing, mainly from bilateral sources, its financing options remain narrow with borrowing costs in international markets still prohibitive, Moody's said in a statement.

Moody's expects Sri Lanka's foreign exchange reserves to continue declining from already low levels. This will further erode its ability to meet sizeable and recurring external debt servicing needs, and increasing balance of payment risks.

According to Moody's, it has extremely weak debt affordability with interest payments absorbing a very large share of the government's very narrow revenue base.

"This compounds the debt repayment challenge. The review will focus on whether the sovereign is able to use time provided by current foreign exchange reserves and bilateral arrangements to implement measures that widen and increase its financing sources for the medium term and avoid default for the foreseeable future," it added.

Sri Lanka's foreign currency country ceiling has been lowered to Caa1 from B3, while the local currency country ceiling remains unchanged at B1.

The three-notch gap between the local currency ceiling and the sovereign rating balances relatively predictable institutions and government actions against the low and declining foreign exchange reserves adequacy.

Fitch raises red flag over large Sri Lankan banks

Meanwhile, Sri Lanka's largest banks are the most susceptible to heightened sovereign risk due to their higher exposure to foreign-currency denominated government securities and, in some cases, weaker capital positions, said Fitch Ratings in a new report.

"Fitch-rated Sri Lankan banks had about one third of their combined assets exposed to the central government as at end-2020, increasing the risk of sovereign stress causing major deterioration in their financial condition," the ratings agency said on July 01.